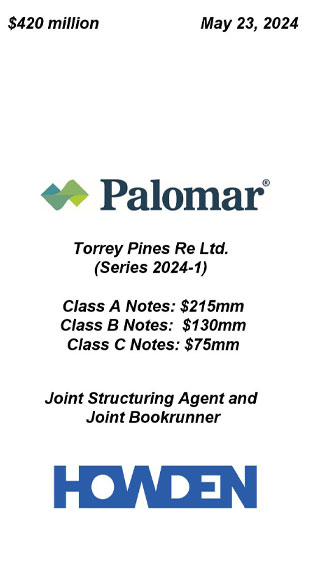

Palomar Specialty Sponsored Torrey Pines Re Ltd. (Series 2024-1) Class A, Class B, and Class C Notes

Transaction Overview

On May 23, 2024, Palomar Specialty (“Palomar”) sponsored its fifth 144A Cat Bond through Torrey Pines Re Ltd.

Torrey Pines Re Ltd. provides Palomar per occurrence, indemnity-triggered event coverage across a three-year Risk Period for the Class A and Class B Notes and a two-year Risk Period for the Class C Notes

Palomar’s impressive underwriting track record resulted in the transaction receiving significant investor support, allowing the deal to upsize and price within initial price guidance amidst a capacity constrained Cat Bond market

- The $420mm transaction represents Palomar’s largest 144A Cat Bond to date

Class A Notes: California Earthquake

- Expected Loss (Time Dependent): 1.58%

- Initial Size: $200mm – Final Size: $215mm

- Final Pricing: 6.00%

Class B Notes: California Earthquake

- Expected Loss (Time Dependent): 2.34%

- Initial Size: $125mm – Final Size: $130mm

- Final Pricing: 7.25%

Class C Notes: California Earthquake

- Expected Loss (Time Dependent): 3.32%

- Initial Size: $75mm – Final Size: $75mm

- Final Pricing: 9.00%

Howden Capital Markets & Advisory Role

HCMA acted as Joint Structuring Agent and Joint Bookrunner

- Assisted in all aspects of the structuring and placement including, but not limited to:

- Structuring and coordinating with legal counsel

- Refining and finalizing offering documents

- (Virtual) Investor roadshow and marketing processes