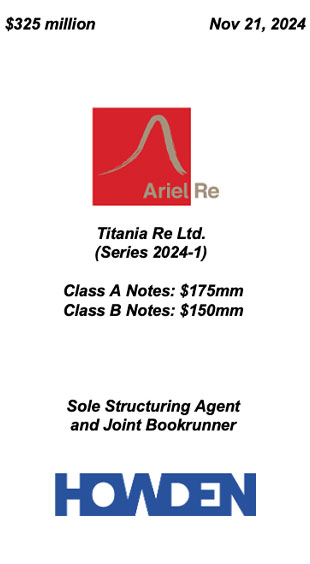

Transaction Overview

On November 21, 2024, Ariel Re sponsored a 144A Cat Bond through Titania Re Ltd.

- The 2024-1 Notes represent the fourth Titania Re Ltd. issuance

- The Class A notes priced at 6.25% – 18% below the mid-point of their initial price guidance

- The Class B notes priced at 9.50% – 13% below the mid-point of their initial price guidance

- For each class, the investor spread tightened by 175bps from the wide end of the initial price guidance

The 2024-1 Notes received strong investor support; upsizing from the original target of $175mm to $325mm

- Class A notes were upsized from $100mm to $175mm and the Class B notes upsized from $75mm to $150mm

- Titania 2024-1 is the first industry loss transaction to be issued in Q4 2024

The Class A and Class B notes offer index-based coverage across the U.S., Puerto Rico, U.S. Virgin Islands, D.C., and Canada

- Each class provides annual aggregate named storm and earthquake coverage

The issuance consisted of Class A and Class B notes of differing risk profiles

- Class A Expected loss (AIR; WSST): 4.14%

- Class B Expected loss (AIR; WSST): 5.52%

Howden Capital Markets & Advisory Role

HCMA acted as Sole Structuring Agent and Joint Bookrunner

- Sole party responsible for working with client to optimize Cat Bond structure

- Presented innovative structuring ideas and assisted in finalizing basis risk analysis

- Assisted in all aspects of the structuring and placement including, but not limited to:

- Structuring and coordinating with legal counsel

- Providing in-depth basis risk analysis to maximize benefit to Ariel Re

- Finalizing investor presentation and offering documents

- Managing marketing process