Transaction Overview

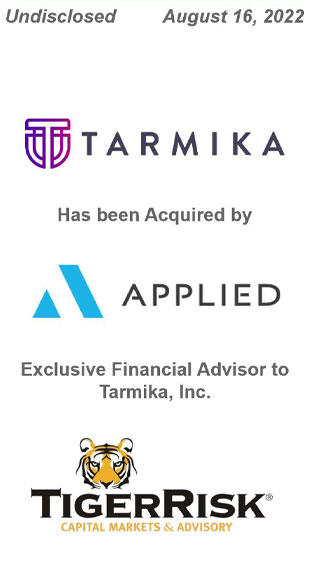

On 8/16/22, Applied Systems, Inc. (“Applied”) announced its acquisition of Tarmika, Inc. (“Tarmika”)

- Terms of the transaction were not disclosed

Tarmika is a single-entry solution designed to streamline the commercial lines quoting process for agents

- Founded in 2018 to build technology that enables carriers and agents to expand distribution channels, gain new business, and provide an enhanced customer experience

- Recently launched a growing embedded insurance product focused on small commercial insurance

- Currently works with over 1,000 leading independent agencies and over 30 insurance carriers

Applied is a leading global provider of cloud-based software that powers the business of insurance

- One of the world’s largest providers of agency and brokerage management systems

- Serves customers throughout the United States, Canada, Ireland, and the United Kingdom

- Hellman & Friedman has been Applied’s majority shareholder since 2014

- Alongside minority shareholders Stone Point Capital, JMI Equity, and CapitalG

Transaction will expand Applied’s commercial quoting and Ivans’ distribution connectivity solutions

- Strategic acquisition to expand portfolio of commercial lines quoting and distribution technologies

- Driving greater connectivity between independent agencies, carriers, and insureds

- Will create a more valuable and digital distribution experience at each stage of the insurance lifecycle

TigerRisk Capital Markets & Advisory Role

TCMA acted as exclusive financial advisor to Tarmika; key roles and responsibilities included:

- Led a targeted sale process focused on most likely strategic acquirors

- Created marketing materials and financial packages shared with potential buyers

- Managed an organized due diligence process

- Offered insights around and assisted in the negotiation of transaction terms and conditions

- Provided objective advice and acted as a confidant to Tarmika throughout the process